Pension funds are increasingly focusing on indirect real estate investments. Ten years ago, indirect Swiss real estate investments accounted for 10.9% of the total portfolio, today this figure has risen to 14.2%. The most popular vehicle is the investment foundation.

Real estate investments remain very popular in Switzerland, both among private and institutional investors. Although, at around 75 to 80 percent of the total property market, privately held properties account for the largest share, real estate investments also play an important role in the multi-asset portfolios of institutional investors, such as pension funds, insurance companies and family offices. Despite the end of the low interest rate period, regular cash flows from rental income and positive value growth keep demand running high. Although there are signs of a slowdown both on the transaction market and in terms of professional investors’ activities in Switzerland, the situation currently suggests a return to normal at a high level. Meanwhile, there is a stable trend towards indirect real estate investments such as funds, investment foundations or stock corporations.

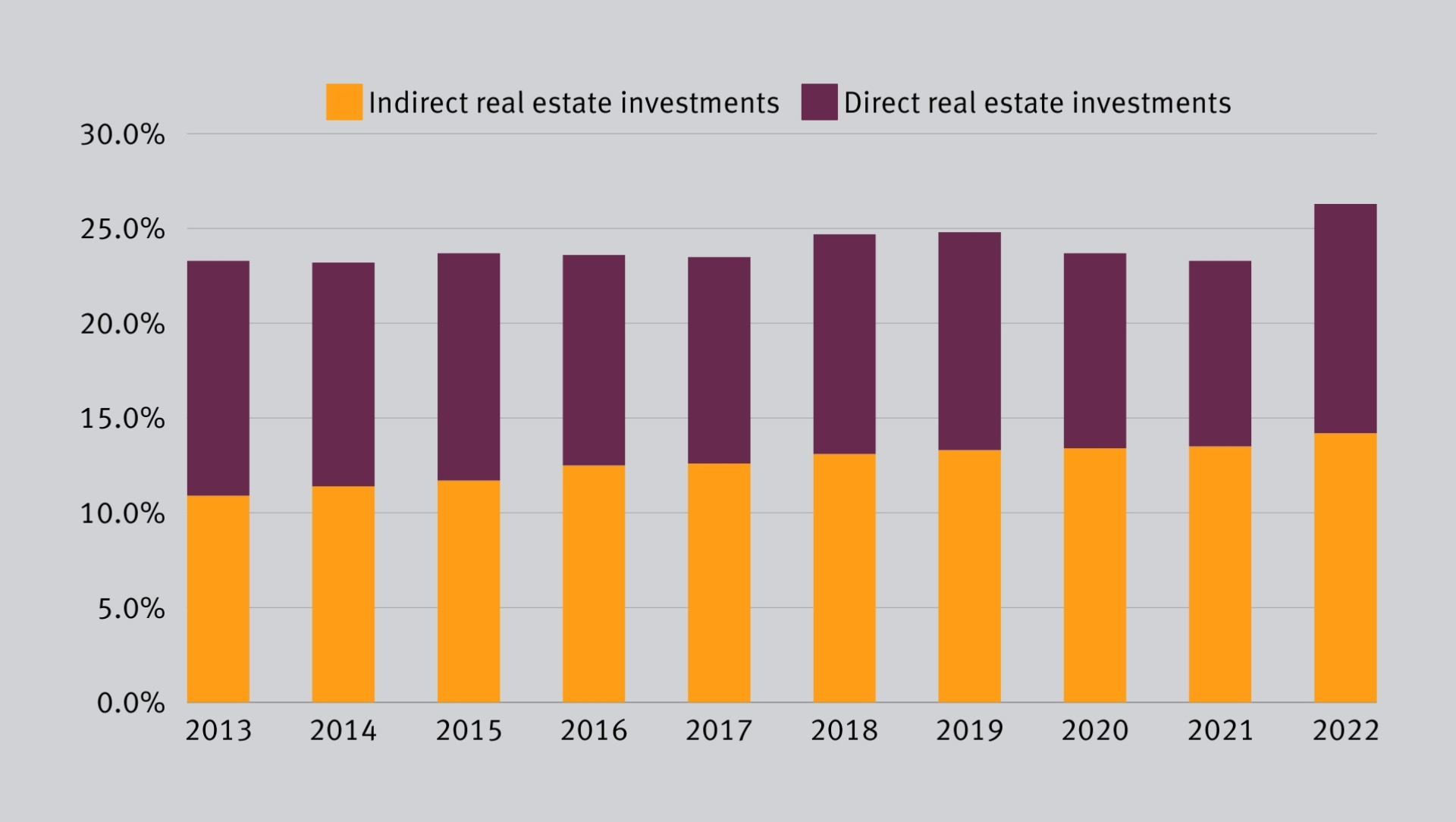

While indirect real estate investments accounted for 10.9% of Swiss pension fund investments ten years ago, this figure has risen to 14.2% and is now higher than the share of direct real estate investments (see Figure 1).

Figure 1: Trend in pension funds’ direct and indirect real estate investments in Switzerland (share of total pension fund portfolio). Source: Swisscanto Pension Fund Study 2023.

Figure 1: Trend in pension funds’ direct and indirect real estate investments in Switzerland (share of total pension fund portfolio). Source: Swisscanto Pension Fund Study 2023.

Indirect property investment vehicles

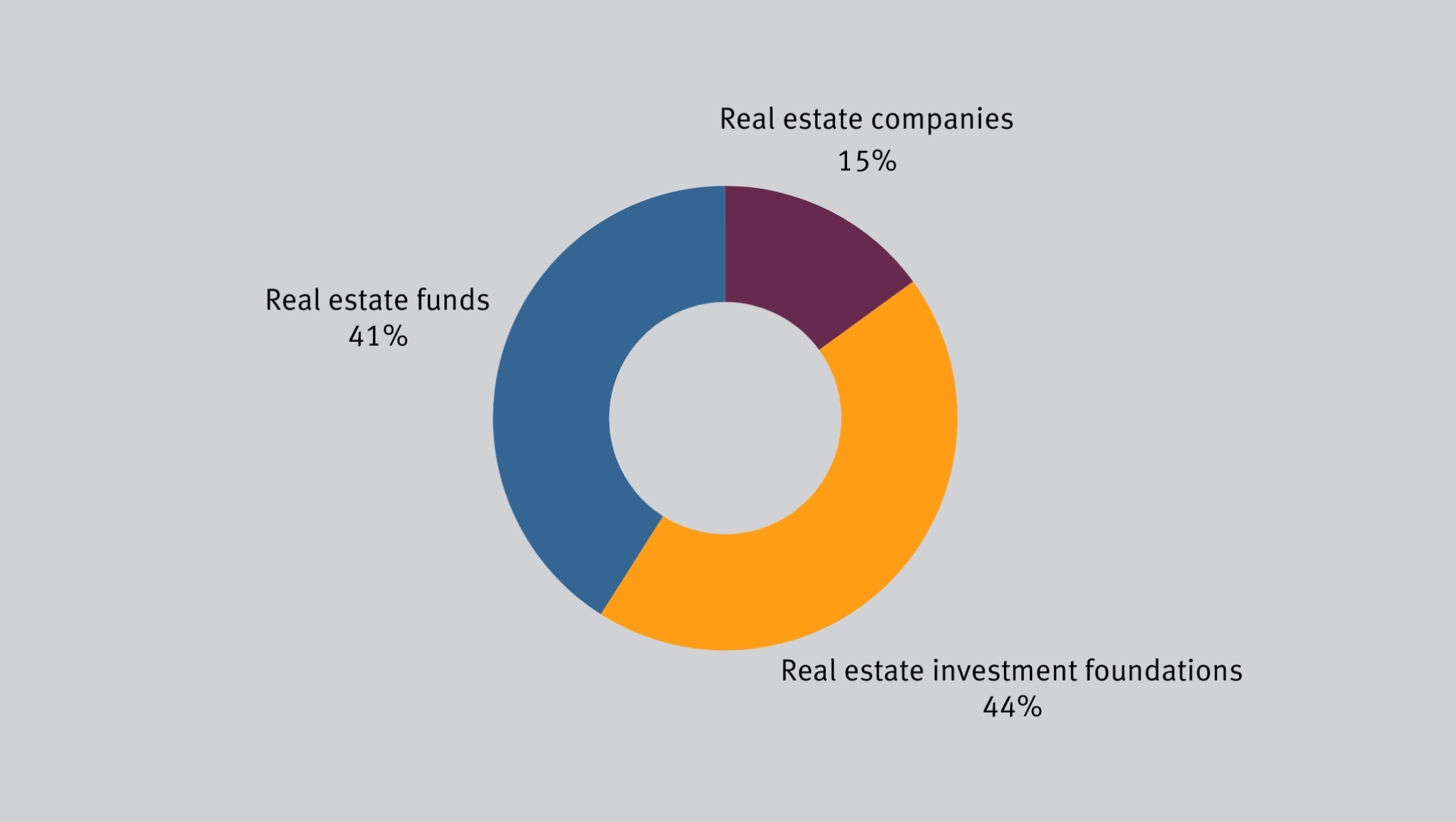

Among other factors, this substantial growth is due to advances in the product range. In addition to direct real estate investments, there is now a large number of professionally managed products, such as real estate funds, real estate investment foundations and real estate companies. While real estate investment foundations are NAV-based investment vehicles, real estate funds and real estate companies can take the form of non-listed or listed vehicles. With more than 9,000 properties held in some 140 different products, annual reports for the year 2022 reported total net assets of all indirect real estate products in the amount of CHF 160 billion. Of these products, real estate investment foundations accounted for 44%, real estate funds for 41% and real estate companies for 15% (see Figure 2).

Figure 2: Indirect Swiss real estate investment vehicles. Source: Alphaprop, 2023.

Figure 2: Indirect Swiss real estate investment vehicles. Source: Alphaprop, 2023.

Investment foundations are a popular choice

Overall, indirect real estate investments have grown at an impressive rate since 2013. While net assets were still just under CHF 71 billion 10 years ago, they had more than doubled by 2022. Investment foundations have become a particularly popular form of investment. During this period, 24 new investment groups were established and net assets under management increased by around CHF 40 billion. In 2022 alone, investment foundations received fresh money totalling around CHF 7 billion and have invested more than CHF 70 billion in real estate investments today. This significant growth was driven by various new launches, the increase in property values and the fact that many investment groups reinvest their income. What makes investment foundations particularly attractive are the extensive participation, information and control rights granted to pension funds. On top of this, there are tax advantages.

Long-term trend towards indirect real estate investments

In Switzerland, many pension funds could optimise their investments considerably by switching from direct to indirect real estate investments. Holding indirect real estate investments through investment foundations and funds offers investors various advantages over direct holdings. On the one hand, pension funds can broaden the diversification of their real estate investments by region and type of use and participate in an established portfolio. Direct real estate holdings often represent a cluster risk associated with individual properties, which are frequently bound up with the pension funds’ corporate history. On the other hand, market liquidity can be boosted as indirect real estate investments are easier and faster to trade. This is an efficient and cost-effective way for pension funds to manage their asset allocation. Investors also benefit from professional external real estate management.

Non-cash contributions ease the switch from direct to indirect real estate investments

Non-cash contributions are an established instrument that allows pension funds to participate in indirect real estate investments and optimise their strategic reallocation. Via non-cash contributions, directly owned properties are transferred without incurring any tax. In return, the pension fund receives shares in the investment foundation. Close consideration should be given to the investment foundation that acquires the properties. Maximum property prices are not always the most important factor. The quality of the investment foundation, as well as its fees, management costs and governance structures, are equally important when selecting an investment foundation.

Advantages of making non-cash contributions to the Avadis Investment Foundation

The Avadis Investment Foundation has long-standing experience in the management of non-cash contributions and offers pension funds attractive investment conditions. What sets its investment groups apart is their stable performance, low costs and high location and property quality. Non-cash contributions are suitable for all vehicles.