Infrastructure investments – promising opportunities for pension funds

Back to overviewInfrastructure investments are still highly underrepresented in the portfolios of employee benefits institutions. The potential of this long-term investment category is significant – but there are risks to consider.

At a glance

Infrastructure investments broaden the investment universe and offer attractive diversification opportunities.

They represent a suitable vehicle for pursuing sustainable objectives.

The success of infrastructure investments hinges on their implementation – the selection of suitable instruments is therefore crucial.

In the last few years, infrastructure investments have attracted more attention from Swiss employee benefits institutions after the Federal Council introduced a new “Investments in infrastructure” category in the revised Ordinance on Occupational Retirement, Survivors’ and Disability Pension Plans (BVV 2) in October 2020. Since then, employee benefits institutions have the option of holding up to 10 percent of their portfolio in infrastructure investments, with requirements largely matching those for “alternative investments”. Under certain conditions, they may also invest directly in infrastructure.

On average, infrastructure investments currently account for around 1.5 per cent of pension assets (Complementa 2022: 32 and Swisscanto 2023: 37), so there is still room for growth.

Gotthard tunnel funded with venture capital

At the global level, the majority of infrastructure investments are currently focussing on North America and Europe (OECD 2022: 25). However, with demand for investment remaining high, infrastructure investment is likely to shift more towards emerging and developing countries in the future. A good example of this is China’s Belt and Road Initiative, which combines private investment with state funding (Nedopil 2023: 3).

Switzerland also has a long history of investing in infrastructure facilities. The construction of the Gotthard tunnel in the second half of the 19th century, for instance, was financed both by public funds and private venture capital (Jung 2017: 409 ff.). However, after the Second World War, the majority of Switzerland’s infrastructure facilities, including railways, roads, electricity grids, water supply and telecommunications, were publicly owned.

In the 1980s, when many facilities were showing signs of age, the need for new investments in infrastructure and replacement investments was rising. With budgets for public infrastructure projects tightening in many places, the state could only provide limited capital. This situation is often referred to as an “infrastructure investment gap” (Global Infrastructure Outlook 2018: 3).

In response, private investors were increasingly granted access to investments in infrastructure. Privatisation took the form of IPOs, trade sales (direct sale to an investor or company) or public-private partnerships (cooperation between the state and the private sector).

What are infrastructure investments?

Infrastructure investments include investments in facilities, systems and services that are necessary for the functioning of society (Carlo et al. 2023: 329). “Economic infrastructure” covers traffic and transport, public utilities, environmental services, renewable and fossil fuels, data infrastructure and communications, while “social infrastructure” relates to education, health, safety and leisure (Inderst 2020: 3 ff.). A distinction is made between greenfield and brownfield infrastructure investments. Greenfield investments are made in start-ups involving new infrastructure projects, for instance the construction of a new hydropower plant. Brownfield investments are holdings in established and operational project companies. An example would be the operation of a toll bridge.

Risk-averse or risk-taking?

Depending on their risk and return preferences (see chart), investors can pursue various strategies in the infrastructure sector. Risk-averse investors (“Core” and “Core Plus” risk profiles), for example, primarily invest in high-quality brownfield projects with stable cash flows in established markets (see box). In the case of both investment strategies, returns are mainly generated from current income. Price gains, on the other hand, play a minor role.

For the “Core” risk profile, average target returns are expected to range between 6 and 9 percent annually over the long term, for “Core Plus” between 9 and 12 percent (Mercer 2021: 4 and J.P. Morgan Asset Management 2023: 2).

Risk takers with “Opportunistic” or “Value Added” profiles, on the other hand, tend to favour undervalued investments with a focus on growth or repositioning. Alternatively, they invest in greenfield projects that generate returns primarily from asset appreciation rather than current income.

Expected target returns for the “Value Added” profile are 12 to 15 per cent annually over the long term (Mercer 2021: 4 and J.P. Morgan 2023: 2). The highest returns can be achieved with the “Opportunistic” profile, with expected returns averaging 15 per cent or more.

Listed or unlisted?

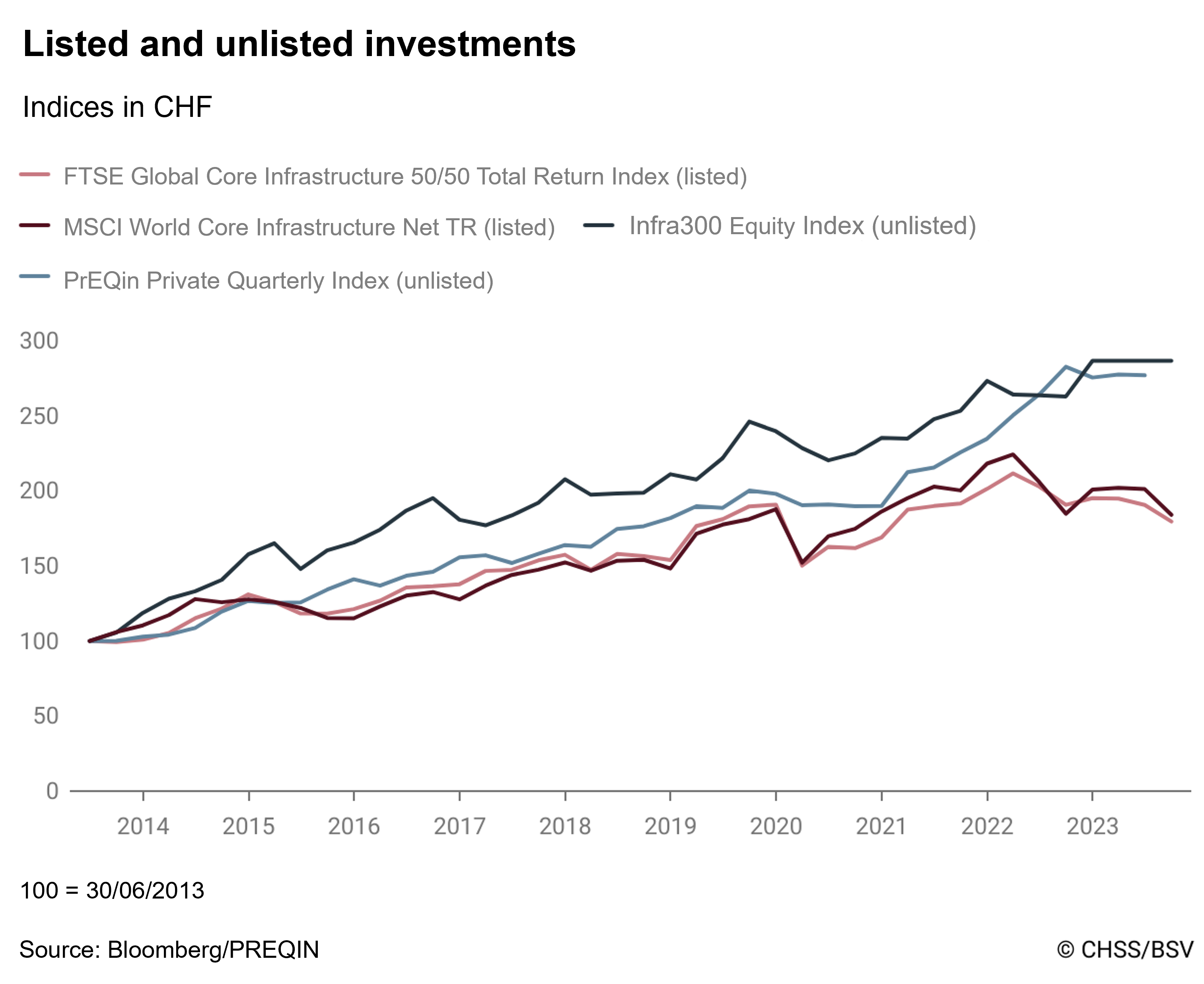

Investors can choose from various instruments to realise their investment objectives. In the infrastructure sector, a basic distinction can be made between listed and unlisted investments. The chart below illustrates how returns on infrastructure investments have developed in the past:

In the case of unlisted direct investments, assets are invested directly in infrastructure companies’ equity or debt capital via project financing or public-private partnerships. This type of investment is difficult to sell and involves a significant amount of capital. What’s more, investing directly in infrastructure projects requires extensive expertise when it comes to evaluating and monitoring investments. This means that only very large investors invest directly in infrastructure projects, usually in the form of partnerships or club deals (joint investments by various investors who pool their capital).

Typically, institutional investors opt for unlisted funds, which in turn can be broken down into closed-end and open-end funds. In the case of closed-end funds, investors pledge their capital to the asset manager in advance, which is then invested in infrastructure companies’ equity or debt capital over a fixed term. At the end of the investment cycle – often after 10 to 15 years – the fund is liquidated via the sale of the investments.

Open-end funds, on the other hand, have no fixed term and offer investors the option of making recurring subscriptions and redemptions. Funds of funds that invest in several individual funds or target funds have established themselves alongside individual funds that focus exclusively on direct investments.

In the field of listed investment opportunities, suitable investments include infrastructure equities and bonds. This means investing directly in companies in the energy, capital goods, transport infrastructure, consumer services, communications or utilities sectors. Units in listed infrastructure funds are another option. Such funds typically invest in equities or bonds of listed companies, in unlisted infrastructure funds or directly in infrastructure projects.

Recognising potential risks

Infrastructure investments are complex assets that involve various risks. For instance, it may not be possible to sell an illiquid investment at the time or price the investor had originally planned. On top of this, any infringement of the regulatory and statutory provisions that frequently apply to infrastructure facilities may result in fines and restrictions, or even the withdrawal of the licence.

Fiscal stimuli also affect the attractiveness of infrastructure projects. Environmental regulations, for example, have a direct impact on budgets, schedules and the public perception of infrastructure projects. Other factors affecting operations include technical and operational requirements. And lastly, infrastructure may become obsolete as a result of changing demand, for instance the replacement of coal-fired power plants with wind or solar farms, or due to technological progress superseding certain technologies, for example in telecommunications.

Given their high capital requirements, direct investments are particularly susceptible to cluster risks. The return on closed-end infrastructure funds is also subject to economic fluctuations depending on the year of launch (vintage). Moreover, whoever puts money into such a fund is effectively investing blindly, as asset managers are free to construct the portfolio as they see fit.

These types of risks can be reduced through appropriate diversification across individual investments, regions, industries, sectors, business segments, investment vehicles, asset managers and vintages.

Sustainable investments are gaining ground

It is likely that the trend towards sustainable investments will further boost demand for infrastructure investments, as they often combine social and ecological criteria. Infrastructure funds, for instance, pursue both social objectives (schools, hospitals) and environmental objectives (renewable energies, public transport). However, this does not mean that they always consist exclusively of sustainable investments. A portfolio may hold both a hydropower plant and an oil pipeline.

A large number of infrastructure investments are inherently political. Given that sudden changes to laws and contracts can have a noticeable impact on the income statement, legal certainty plays a key role for infrastructure investments.

Bibliography

Carlo, Alexander; Eichholtz, Piet; Kok, Nils, Wijnands, Ruud (2023). Pension fund investments in infrastructure. Journal of Asset Management (2023) 24: 329–345.

Complementa (2022). Risiko Check-up Studie. Zur aktuellen Lage schweizerischer Pensionskassen.

Global Infrastructure Outlook (2018). Infrastructure investment needs: 56 countries, 7 sectors to 2040. Global Infrastructure Hub.

Inderst, Georg (2020). Social Infrastructure Finance and Institutional Investors. A Global Perspective. Inderst Advisory - Discussion Paper, September 2020.

J.P. Morgan Asset Management (2023). Private Infrastructure Outlook 2023. January.

Mercer (2021). Infrastructure investing – A primer.

Jung, Joseph (2017). Alfred Escher (1819–1882). Aufstieg, Macht, Tragik. Zürich, NZZ Libro, 6th edition.

Nedopil, Christoph (2023). China Belt and Road Initiative (BRI) Investment Report 2022, Green Finance & Development Center, FISF Fudan University, Shanghai.

Swisscanto (2023). Schweizer Pensionskassenstudie 2023. Zürcher Kantonalbank.