Middle ground: striking a balance between caution and opportunism with mid-market private equity

Back to overviewThe mid-market segment remains an attractive proposition for private equity investors

Public sector: a look beneath the surface

Despite a brief blip in April, the S&P 500 remains on a growth trajectory, thanks largely to the performance of the widely discussed «Magnificent 7» [1], along with anything remotely related to AI. Beneath the surface, however, the public market statistics look less auspicious. Exclude the Magnificent 7 and the rise in share prices is less significant, with small and mid-cap stocks still languishing in negative territory.

Given the higher share valuations, persistent inflation and the continuing uncertainty surrounding the interest rate outlook, investors should maintain a healthy balance between caution and diligently planned opportunism.

Investment risks should by no means be ignored. In fact, investors should make a clear distinction between perceived and actual risks. This will help them identify investment opportunities with a particularly high performance potential, despite – or precisely because of – the risks. The private mid-market segment is currently offering good prospects for putting this strategy into practice.

Private mid-market: driving the economy

Consisting of around 200,000 companies, the US SME sector has been a driving force in the economy for decades. The mid-market has performed well in the post-pandemic period: According to the US National Center for the Middle Market, a record 83% of mid-market companies reported year-on-year revenue growth in 2023.

Capitalising on SMEs: why bigger is not always better

While the size and composition of the SME market presents challenges in terms of value creation, it also offers opportunities. Private equity funds are the primary vehicles offering solutions for investing in this diverse economic sector.

Mid-market private equity managers have a strong, long-term track record of outperforming their large- and mega-cap peers. Alpha generation is fuelled by specific skills and features unique to the mid-market that have proven to last over time.

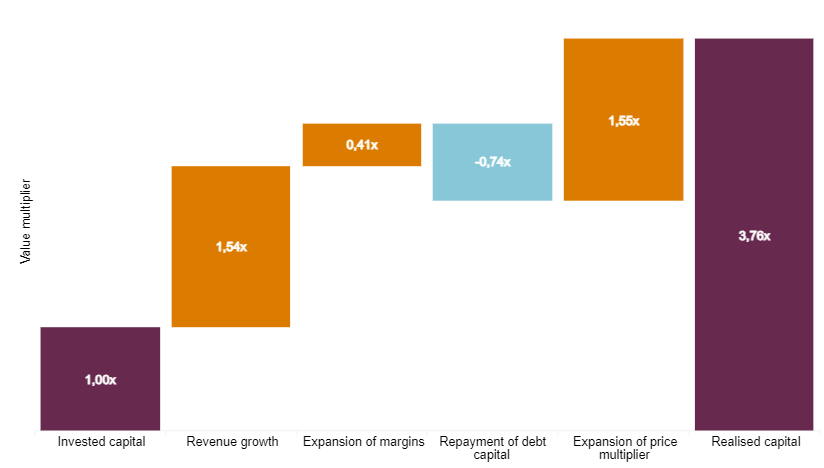

Specifically, these features include lower entry prices, multiple ways to create value, more options for selling portfolio companies and, last but not least, less dependence on debt capital. The latter point is particularly important in today’s high-interest rate environment, where rising capital costs have slowed down M&A transaction volumes. Unlike the broader market, the mid-market segment is already showing signs of recovery. With higher interest rates driving up the cost of financing acquisitions, fund managers are having to focus more on operational improvements if they want to increase value for investors. Looking at the historical drivers of mid-market value creation, the evidence is encouraging.

[1] The Magnificent 7 include the following stocks: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla.

Value drivers for mid-market buyouts

Source: Preqin

Source: Preqin

Thanks to the aforementioned distinguishing features, the private equity mid-market segment should remain a more attractive alternative to investments in larger caps. Given the size of the market and the relative inefficiencies, return opportunities for mid-market buyout managers remain significant. That said, it is hard to overemphasise the importance of manager selection, considering that the market is relatively fragmented with an enormous number of buyout funds focusing on small and mid-cap companies. Generating an outperformance requires systematic selection of managers from the broad spectrum who can demonstrate both outstanding operational expertise and the ability to gain a competitive advantage when it comes to sourcing deals.